Hiring Made Smarter With AI

Automate resume screening in minutes

Track and manage candidates

effortlessly

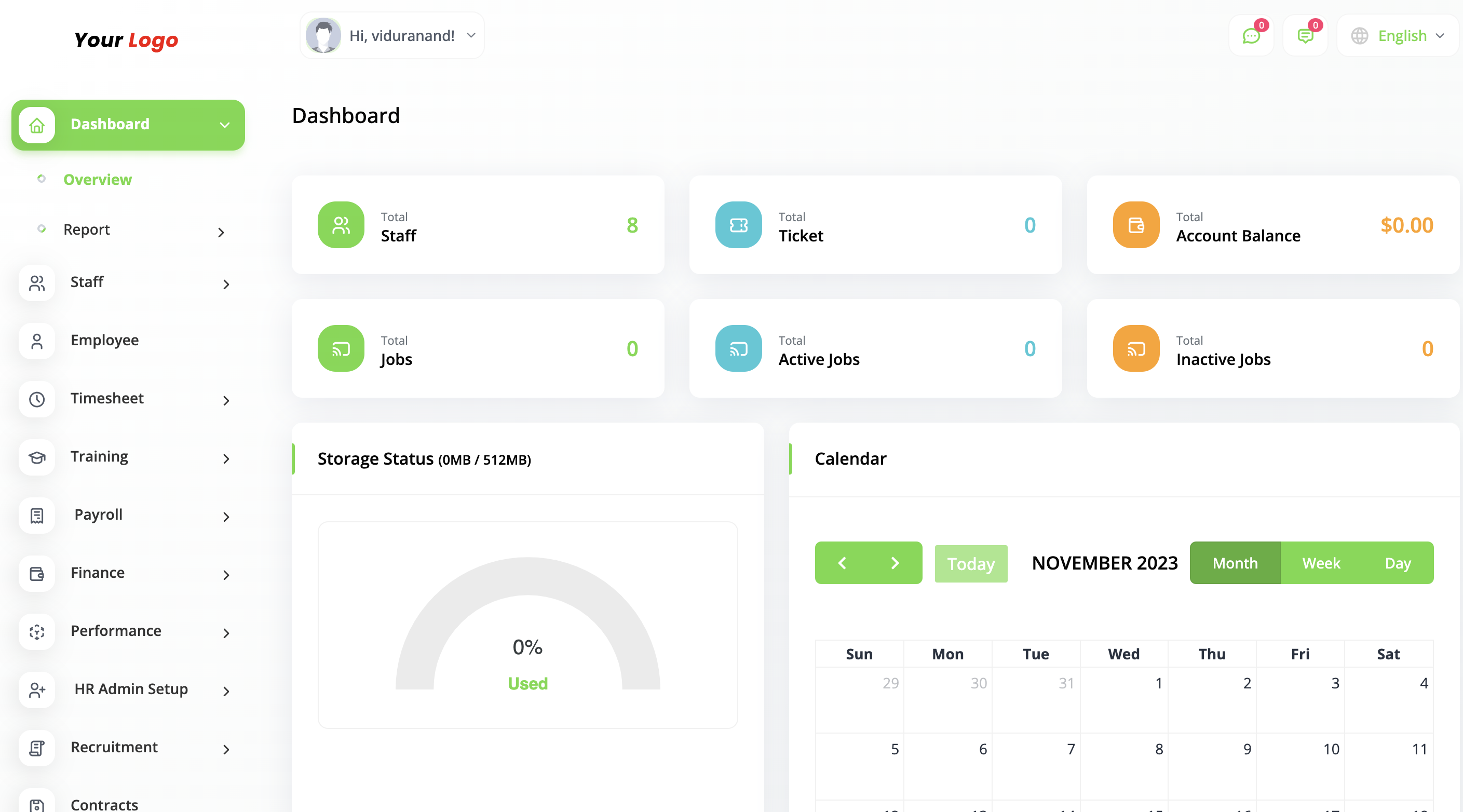

Simplify employee onboarding & records

Transform Recruitment & HR Management Into a Seamless Experience

Book A Free Demo